Introducing Curvo: a better way of saving money

· 677 words · 4 minutes read

Together with Thomas, my co-founder from Sutori, we started a new side-project called Curvo. With Curvo, we want to drastically improve the financial well-being of our generation by passively investing your savings instead of keeping it all in a savings account. It grew from the realization that investing is difficult, time-consuming, yet is crucial for our generation to be prepared for the future.

My journey into passive investing

If you’ve read some of my writings, you will have noticed that I mostly write about personal finance and investing. This is an interest of mine that grew out of the frustration of the low returns for my savings account and a will to be better prepared for my future. Since then, I’ve become convinced that passive investing is the best form of investing for most people.

Investing is hard

As I dug into the world of investing, I realized how difficult it is to get started. You have to define your portfolio, find a broker, know about taxes,… Acquiring this knowledge and skills takes a lot of time, perseverance and a certain confidence in your own capacity for taking good decisions. The finance world is intimidating, filled with jargon and full of people who want to separate you from your money. Having gone through the whole process, I’m not surprised that hardly any of the people around me invest their money.

This problem is especially important in Europe, where services like Wealthfront or Betterment aren’t available.

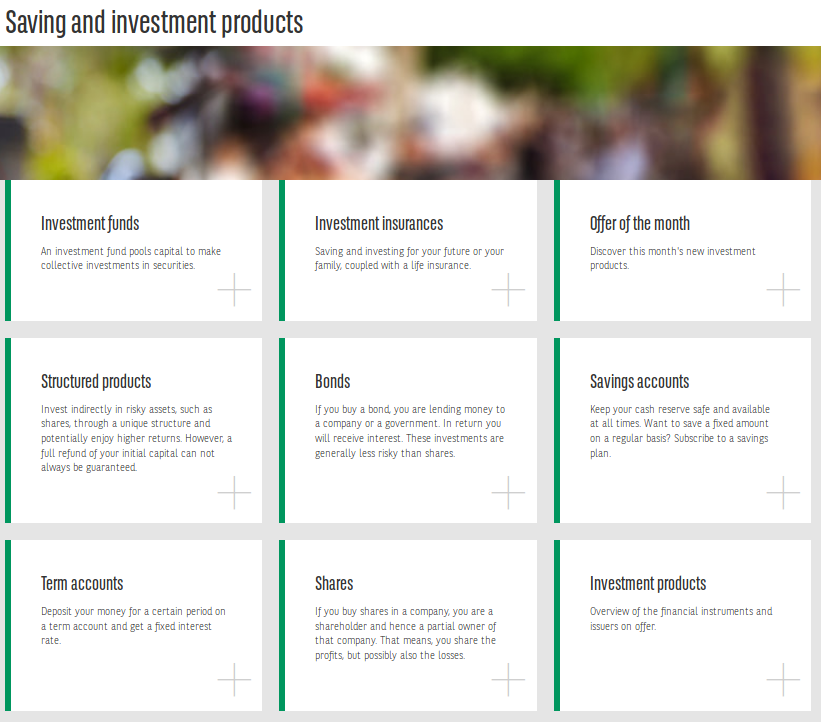

The image above is a screenshot taken from the website of an actual bank. The average person who has no financial knowledge and who comes onto this page, is presented with too many options and technical terms. It’s understandable if he then clicks away and thinks “Nevermind, I’ll just leave my money in my savings account.".

Our generation is facing a scary financial future

At the same time, I became aware that our generation, the “millennials”, is facing a scary financial future and needs to be better prepared financially. Our state-funded pension systems are under increasing pressure due to changing demographics. For instance, 40% of the Belgian population will be over the age of 67 by 2060 whereas today, only 25% of the population is in that age group. I think that our pension systems will need to adapt in such a way that individual contributions will become more and more important.

So we started Curvo

For these reasons, me and Thomas started Curvo: our goal is to improve the financial well-being of our generation by giving easy access to passive investing. No need to read dozens of books on how to define your asset allocation like we did. No need to study the Bogleheads wiki to learn about taxes in your country. There’s even no need to know what an index fund is. With Curvo, you will be able to boost your savings while requiring no financial knowledge. And by pushing automation, it won’t require any of your time either.

At the same time, we see a big need for educating our peers on how to live a financially healthy life. The number of people who have little savings and are living paycheck to paycheck is scarily high. This is a very dangerous situation to be in as it exposes you to big risks, for instance in case of illness, disability, losing of a job… Our second mission therefore is to arm our customers with the right knowledge to improve their financial lives.

We are using the experience that we acquired in building Sutori, an educational platform that we scaled to over 1 million teachers and students across the globe using it. We have learned a lot over the past few years on how to grow a product and build a brand that is used and loved by this many users. We are now applying these skills, knowledge and experience to Curvo.

Built for Europeans

If Curvo piques your interest, don’t hesitate to head over to curvo.eu and try out our calculator to see how much you can improve your savings.